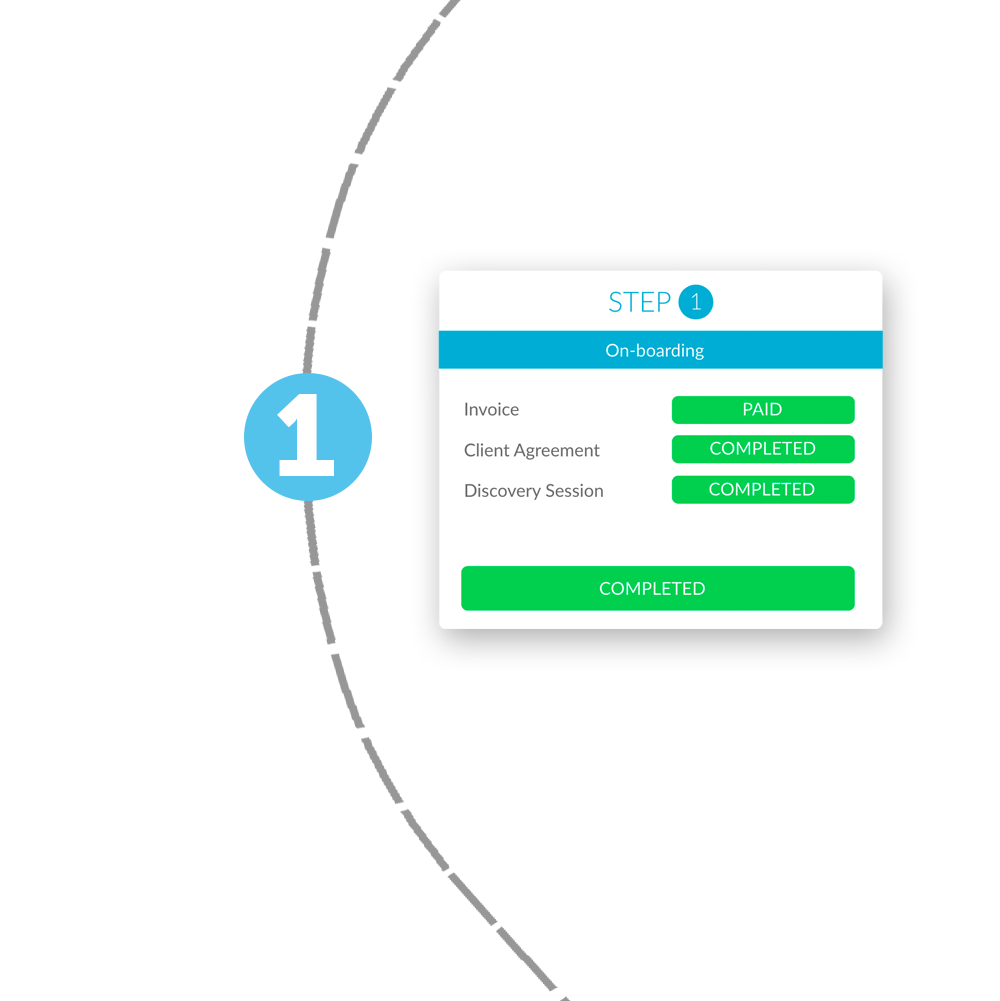

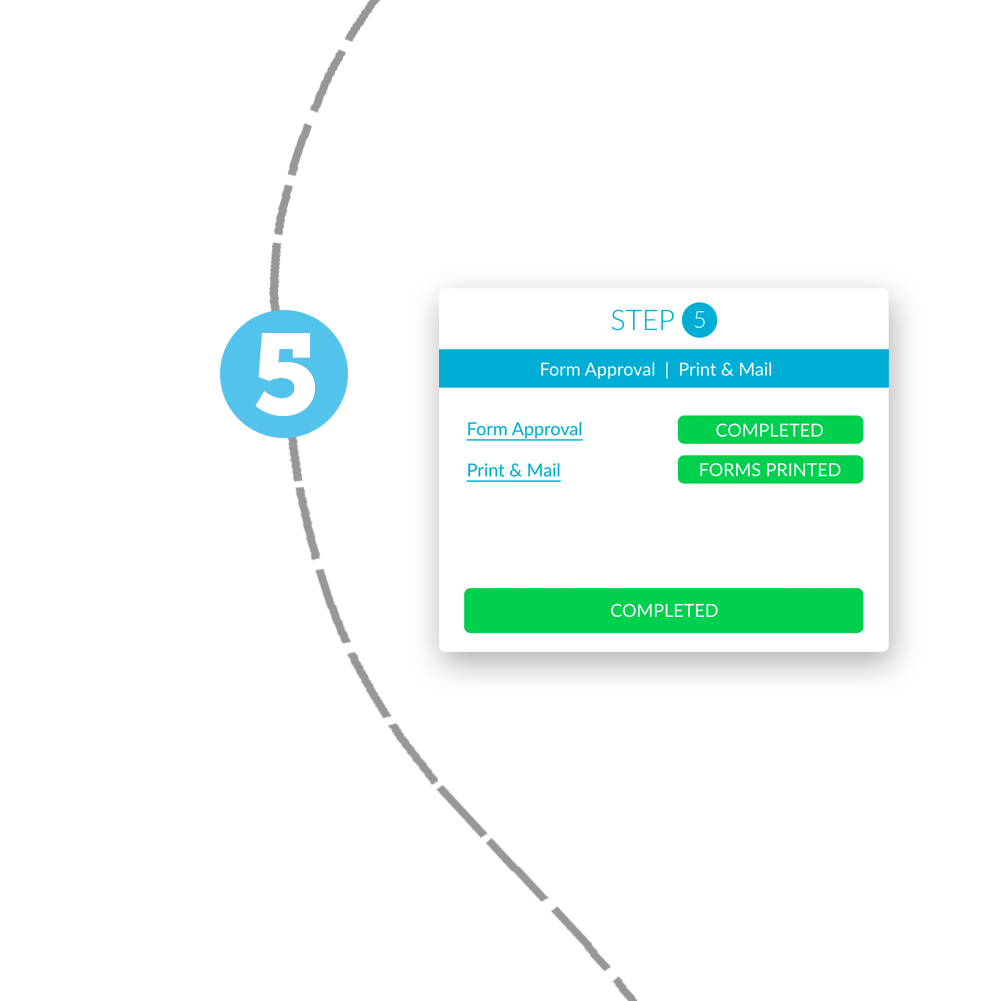

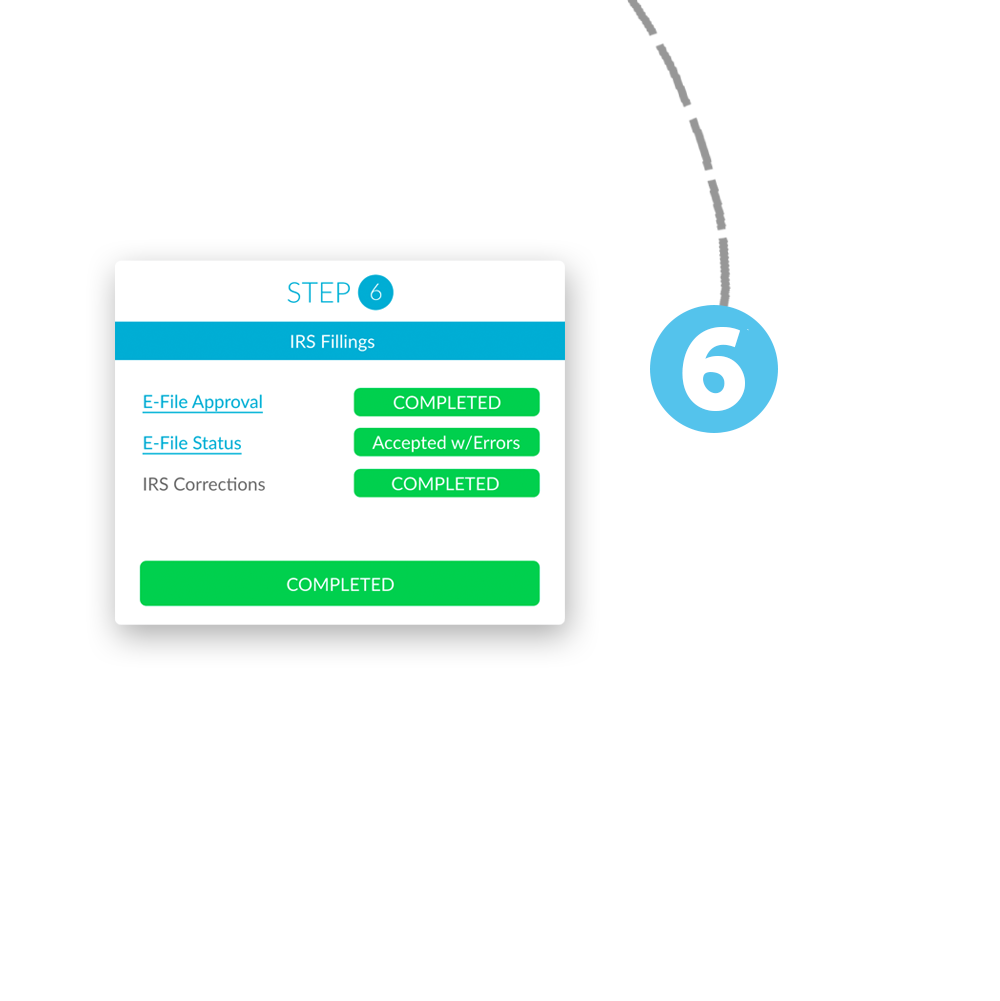

Our Steps For Reporting Success

We work very hard to provide paths for every client to have a great service experience. That starts with upfront communication from our team about package options, and minimum data requirements.

New users follow prompts to move through the steps of a customized online software. Every client ultimately finishes with completed 1094 & 1095 forms and successful electronic transmission of company information to the IRS.